Algo Tokenomics

Introduction

The Algorand blockchain network has its own native cryptocurrency, the Algo. At the genesis of the Algorand blockchain, 10Bn Algo was minted. As of September 2022, circulating supply is approximately 6.9b Algo, distributed through different forms of ecosystem support and community incentives. The remaining Algos are held by the Foundation in secure wallets with the following composition:

ALLOCATION

ALGO

Community & Governance Rewards

1,757.26 Million

Ecosystem Support

1,176.05 Million

Foundation Endowment

363 Million

This page reports the dynamics of the Algo circulating supply from the genesis block. The distribution of the resources is regularly communicated to the community through our semiannual Transparency Reports. Following the above allocation, the distribution has the main purpose to support the development of the economic ecosystem built on the Algorand public platform, and to reward the participation of the Community to the Algorand Decentralized Governance and the contribution to the economic network activities.

The Foundation’s role is fostering the growth and the decentralization of the ecosystem. The relevance of Decentralized Governance in leading the distribution is increasingly growing. Governors have already voted to decide the balance between the level of their rewards and their commitment, and to set up the different requirements for governance and the different roles.

For the initial period of Algorand history, the distribution was based mainly on a number of different ecosystem programs, such as universities and grants, and on algorithmic rewards to community, early backers, and network service providers. The main goal was decentralization and inflation control. More details are given in the Algo Dynamics plan published 1.5 years after launch. The main aspects that have evolved since then are:

- The fixing of the circulating supply computation in September 2021 has aligned the definition of our circulating supply with the market standard with an increase of 1.6B Algo with no outflow.

- The Algorithmic Vesting, with the feature of slowing down vesting while allowing accelerations based on market conditions, completed in October 2021. It has released 2.135B Algo between the first significant acceleration in August 2020 and the completion of algorithmic vesting on October 6, 2021.

- The remaining part of the Contingent Incentives set up originally for unexpected ecosystem needs has been allocated to fuel the ecosystem growth, which is now treated as a unique fund to strengthen economic and social activities. This marks the moment in the Algorand ecosystem when, after decentralization and distribution of over 65% of the supply, the focus is the investment in the growth of the ecosystem, tackling opportunities beyond the growing effort previously planned.

- The introduction of Decentralized Governance has given to the Community the possibility to vote on important issues for the platform and the ecosystem. This has led to the replacement of Participation Rewards with Governance Rewards, with the latter depending in part on Community votes.

These changes require an update to some of the previous Long Term Algo Dynamics allocation plans.

Ecosystem Support

The increase of the Ecosystem Support fund has allowed to increase Ecosystem allocation. In the chart below we see the future distribution assuming a flat allocation for every year from now to 2030. The allocation does not imply an immediate market distribution. The chart also shows the market distribution if only 60% of the allocation is spent in the first year while the rest is spent in the next four years. This has to be compared with the 2020 Ecosystem chart plan, which assumed lower allocations and slightly slower distribution. Beyond 2030, ecosystem support will come from generated income.

Governance Rewards

The introduction of Decentralized Governance has already given to the Community the possibility to choose the level of their Rewards for being a governor. In order to avoid a trivial choice, the measure regarding the Rewards in the first year gave the choice between higher rewards, with a componente of slashing in case of earlier withdrawal, and lower rewards without any slashing. The choice was to go for a lower amount, signaling community aversion to slashing.

In the future, measures may still affect rewards, including non-trivial elements of commitment for governors in the option with higher rewards. In case the lower-rewards option reduces rewards by 30%,moving the saved rewards to after 2030, we can have the situation represented in the chart below. In case the choice is always to have lower rewards, the allocation is the blue line. In case the choice is always to have the higher amount, the distribution is the gray line, till the time when a self-sufficient rewarding system is developed in a mature ecosystem.

The chart has to be compared to the ‘Community Incentives: Participation Rewards’ chart in the 2020 plan, where the allocation, for Participation Rewards before Governance Rewards, was always at the higher amount.

In the future, the evolution of the network and the ecosystem, and of Governance reforms such as the introduction of the xGovs that can propose measures, may lead to further allocation changes.

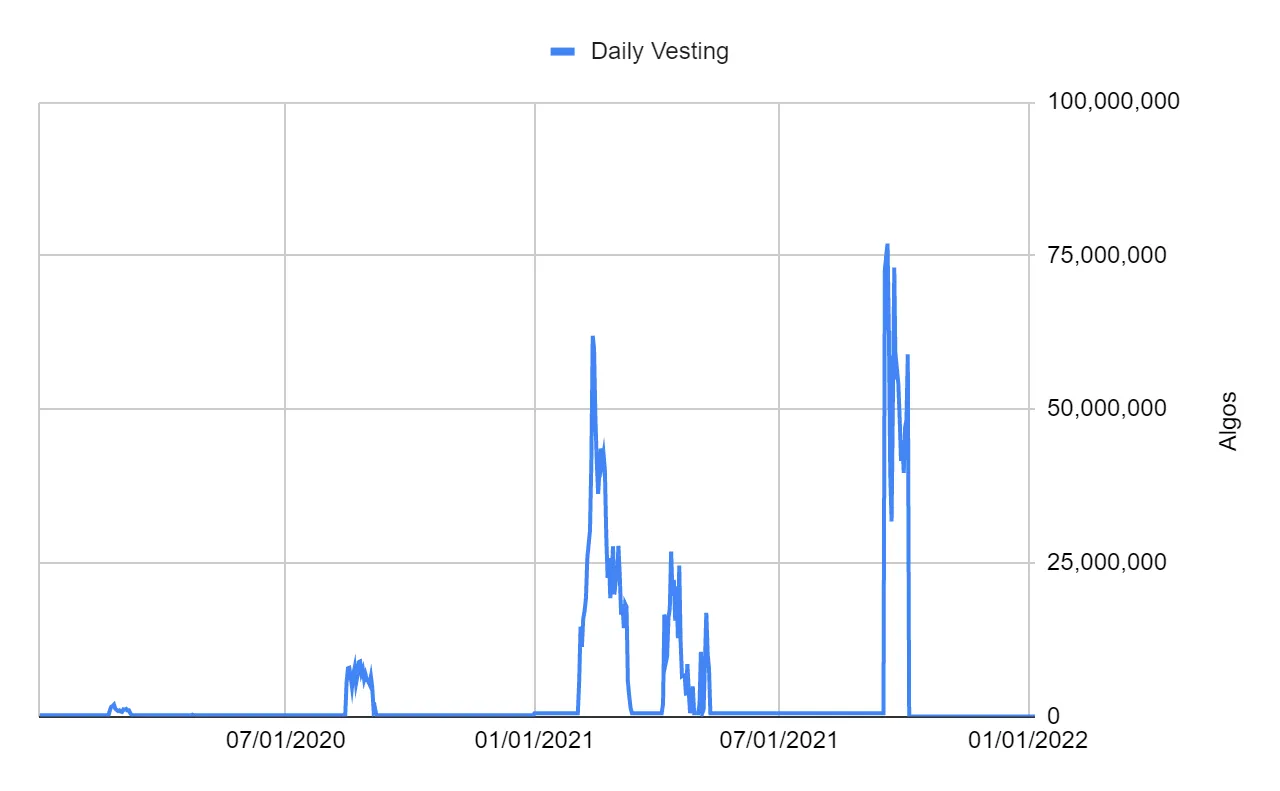

Algorithmic vesting for Early Backers

The completion of the distribution of the vesting for the Early Backers, who were also the Relay Node Runners until the vesting was completed, is briefly summarized here. More details can be found in the specific report linked at the end. The original plan from before launch was the distribution of 2.5B Algo with daily even installment over the first two years after launch. When started, it led to an initial inflation spiral and was reformed with a new agreement between Early Backers and the Foundation to stop the vesting first and then slow it down, spreading it over 5 years. The deferral was compensated with 625M from the initial Contingent Incentives Fund and an algorithmic element that could anticipate distribution if a one-month moving average of the price, market cap and other market parameters kept going to new historical highs during the distribution, and stopping if that was not happening. These conditions materialized once for a shorter period in 2020 and for a few more periods in 2021, leading to the exhaustion of the vesting on October 6, 2021. Only a fraction was not distributed by that time for technical reasons and was distributed later without the algorithmic component, as reported in the subsequent Transparency report.

In the chart below we can see a comparison of the original vesting agreement (red bars), the baseline of the new agreement making vesting slower (dark blue and dark gray bars), and the actual distribution (light blue, light gray) based on how the algorithmic component adjusted to market conditions.

From the chart we can understand the issue much better: the original agreement (red) started to distribute heavily at the beginning and was supposed to peak in 2020 and end in 2021. The new EIP agreements (dark blue, dark gray) moved most of the vesting in 2022-2023-2024. The algorithmic component did not accelerate the vesting for most of 2020 but found best conditions for distributing during a few months in 2021 and terminated vesting strategically, leading to the actual distribution (light blue, light gray).

The algorithm worked as expected, distributing a very significant component of the circulating supply with growing prices vs dollars and even above BTC growth, in spite of the strong bull market the largest cryptocurrency was into till the end of the year. This also allowed a significant growth in market cap ranking due to the distribution coupled with deflation (remembering that part of the circulation supply growth was due to the fixing of the circulating supply computation in September 2021, a change in Coinmarketcap approach without any supply impact).

More details about vesting, based on the information made public during the vesting process and on subsequent analyses, are provided in the vesting report.